Competitive Rates

We work hard to keep our costs down and pass the savings on to you. That’s how we’re able to offer great loans—and great rates—that our competitors can’t match.

Same-Day Pre-Approvals

We offer same-day pre-approvals you can rely on. Find out your personalized rates in no time!

A+ Rating with BBB

Our past clients are happy, and it shows. We’re proud to have the highest possible rating with the Better Business Bureau, because it means we’re doing right by our customers.

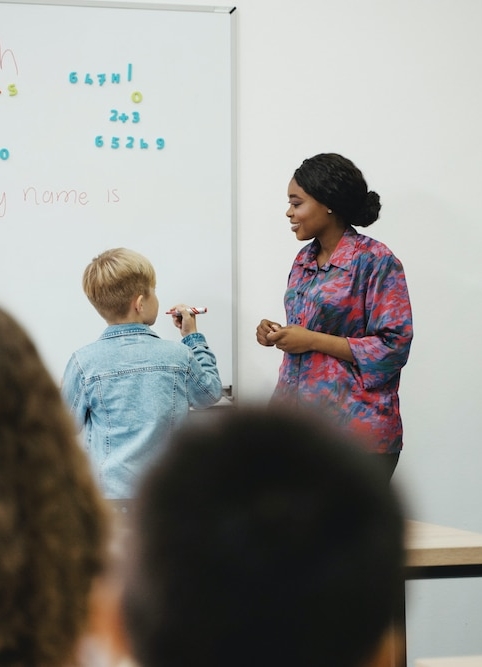

What is the Teacher Appreciation Program?

Our Teacher Appreciation Program is a way to thank you for your dedication and sacrifice. Right now, we’re offering a $500 Target GiftCard to help pay for school supplies for all education professionals–including teachers, administrators, coaches, custodians and more–who purchase a new home or refinance this year. We’re doing this because we want to support the outstanding work America’s teachers do, both in our schools and in our communities.

Many teachers and other school staff face financial challenges due to limited income, but the process of receiving a home loan doesn’t have to be one of those challenges. When you call us to discuss your loan options, we’ll help connect you to the many options and assistance programs that can help secure great mortgages for teachers.

Does the Teacher Appreciation Program Work with Any Loan?

Yes! The Teacher Appreciation mortgage can be combined with other loans, including those that are designed to assist teachers and other public servants.

-

Good Neighbor Next Door program

The Department of Housing and Urban Development (HUD) offers the Good Neighbor Next Door program for K–12 teachers. It applies to eligible single-family homes in revitalization areas, and it provides an incentive in the form of a 50% discount off the list price of the home. The buyer has to commit to making the property their principal residence for 36 months.

For the purpose of this program, a person qualifies as a teacher if they are employed as a full-time teacher by a state-accredited public or private school and works in the locality where the home is located. The downside for some education professionals is that this program is only available to classroom teachers and does not apply to administrative or other types of school staff.

-

Teacher Next Door program

The Teacher Next Door program offers grants of up to about $4,000 and down payment assistance of up to about $10,000. All pre-K through 12th grade classroom teachers are eligible, as well as college and university professors. There is also a program for non-instructional school personnel including administration, office staff, lunchroom staff, custodians, and para-professionals.

Another key difference between Teacher Next Door and the HUD program is that education professionals taking advantage of this program can purchase any home on the market, regardless of the area.

-

State and local mortgage for teacher programs

There are many state, county, and local programs that teachers can take advantage of. For example, Homes for Texas Heroes applies to full-time K–12 public school professionals, including classroom teachers, teacher aides, school librarians, certified school counselors, and school nurses. It offers up to 5% down payment assistance, and you don’t have to be a first-time homebuyer to take advantage. Income limits vary by county. Remember, our Experts are knowledgeable about programs in different states and will help you understand all the options that are unique to your area.

What’s the Process of Getting a Home Loan for Teachers?

At The Home Loan Expert, we want to make the process of securing a home loan easier on teachers. You work so hard to improve the lives of your students, so we want to do the hard work for you when it comes to buying or refinancing a home! Our process is quick and painless, and it begins when you start our application process.

After that, you’ll work with a loan officer who will learn more about your expectations, preferences, and financial needs. We do all the paperwork and handle everything under one roof, originating the loan from start to finish. This means we can work extra efficiently … we can even close for prepared buyers in as little as two weeks!

How Can The Home Loan Expert help?

As a direct mortgage lender, The Home Loan Expert streamlines the entire mortgage process and makes everything easier on you. Because we handle the whole process, we’re able to approve loans that our competitors can’t, giving you more competitive terms that make your house buying or refinancing goals possible. Our unique approach also allows us to tailor home loan options to your unique needs as an education professional. No matter your situation, we’ll work hard to find the exact loan terms that work best for you.

Aside from being knowledgeable experts in our industry, we also provide superior customer service, taking good care of you from the moment you begin your approval process through closing. And, don’t forget that you’ll get a$ 500 Target GiftCard from us at closing!

We’re one of the fastest growing lenders in the nation, and our goal is to help more educators like you make their home buying dreams come to fruition. Our company was founded on a passion for helping people, and we’ll always put the needs of our customers first.

We appreciate everything you do as an educator,and we want to express our gratitude by helping you secure a great home loan with a rate you’ll love. Start your application today to take advantage of our teacher appreciation loan program.

Learn About Other Loan Types

Adjustable Rate Mortgage

When you’re shopping for a new home, one of your most important decisions will be what kind of mortgage to take out to finance your home. Your mortgage type will be the top factor that influences how much you can borrow(and thus what kind and size of home you purchase), as well as your monthly budget moving forward. For a variety of reasons, an adjustable-rate mortgage (ARM) can be an appealing choice in the short term, but it can seem scary as well. However, it’s important to understand how ARMs work, since this type of loan has repayment terms that may become less desirable over time.

FHA Loan

The home buying process can be overwhelming and stressful, especially if you’re buying your first home (or if your financial circumstances make it more difficult to get an affordable loan). For many home buyers, getting a loan insured by the Federal Housing Administration (FHA) can be extremely helpful in not only securing the necessary financing to buy but also achieving the dream of owning a home (even while facing tough financial situations). FHA loans allow lenders to make home buyers better deals, resulting in lower down payments, lower closing costs, and easier credit qualifying. Here, we’ll go over the ins and outs of FHA loans, including what they are, who qualifies, and what the process of securing one looks like.

Fixed-Rate Loans

Fixed-rate mortgages—also called “conventional mortgages”—are basically the bread and butter of the mortgage industry. And that’s because this loan type is still the most reliable way to finance your home, offering affordability, flexibility, and so much more. As their name suggests, fixed rate loans have the same rate throughout the entire term of the loan. So even if interest rates rise while you’re paying off your loan, your rate and payment amount are locked in for the entire loan term. That’s why fixed-rate mortgages are so popular–they offer protections that ARMs can’t.